Author Daniel Gross first points out that the four Republicans on the Financial Crisis Inquiry Commission are trying to ban these words from the final report: Wall Street, shadow banking, interconnection, and deregulation. Well, why learn from history when you can just rewrite it?

It gets better:

Barry Ritholtz at the Big Picture has an interesting post today on the bio and affiliation of one of those GOP-appointed members: Peter Wallison of the American Enterprise Institute.

Wallison, a longtime critic of Fannie Mae and Freddie Mac, is generally of the opinion that government policy was responsible for the financial crisis. (Never mind that Fannie and Freddie had nothing to do with AIG, credit default swaps, the implosion of Bear Stearns, the huge losses in private equity, the commercial real estate debacle, etc.) A firm believer in financial deregulation, he was co-director of the American Enterprise Institute's Financial Deregulation Project. But Ritholtz notes that AEI has scrubbed Wallison's bio to remove any reference to deregulation. He writes: "Indeed, any reference to his participation on the Financial Deregulation Project is gone from Wallison's AEI bio. Instead, the language has been replaced with the more benign 'co-director of AEI's program on financial policy studies.'"

Here's Barry Ritholtz himself:

The language change is a poor attempt to hide Wallison’s role in the radial deregulation of derivatives, banking, leverage and sub-prime mortgages from casual inspection.

This Intellectual dishonesty is telling, but unnecessary. Many people from across the political spectrum agree with the AEI that the bank bailouts were wrong, that corporate giveaways are inappropriate, and that the government created Moral Hazard.

However, some of those people consider data, facts, details, as part of their analysis.

Wallison, like most idealogues (on the Right and the Left), suffers from cognitive dissonance: When presented with facts that challenge or contradict his ideology, their brains get flummoxed. Rather than accept the possibility that deeply held beliefs are wrong, the mind fabricates rationales and excuses for the evidence in front of them. The same cognitive factors that lead sports fans to blame the referees when their teams fail to impress also lead idealogues to ignore facts and focus on beliefs. Hence, the wingnut obsession with the CRA, Fannie Mae, even Acorn as the prime cause of the crisis.

Of course, the right wing is busy trying to blame the whole economic collapse on Fannie Mae and Freddie Mac since they can point to Democratic support of those organizations - and, incidentally, whitewash their own culpability. Well, that certainly deserves criticism, I'm sure (although that promotion of home ownership was hugely popular with the general public at the time). But that really can't explain the worldwide nature of this crisis.

After all, Fannie Mae and Freddie Mac only affect mortgages in the United States. So how could they be responsible for an economic collapse of worldwide scope?

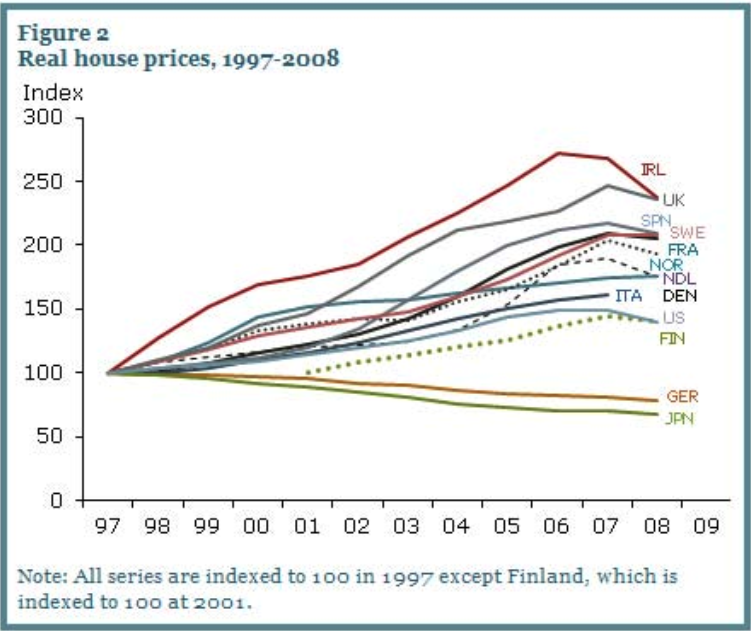

In a separate post, Ritholtz makes this point, too, with reference to the above chart:

Pray tell what caused the same boom and bust in these other nations?

And how could Fannie/Freddie or the CRA be responsible — that only applies to the US — when you have the same, global, coordinated rise in prices? (And you can add Korea and New Zealand to the chart above).

For those of you who still believe the political talking point that it was FNM/FRE/CRA’s fault, the question remains: What caused these other nations to boom the same time the USA did? ...

The US Federal Reserve’s monetary policy, on the other hand, did have a global impact. The US has the world’s reserve currency, the biggest economy and the most important central bank. When the Fed took rates down to 1%, it had an ginormous impact on everything priced in debt, dollars or leverage. That includes housing, around the world.

And here's Nobel Prize-winning economist Paul Krugman:

Barry Ritholtz expresses amazement at the way the Fannie-Freddie-CRA lie — the claim that gubmint bureaucrats forced all those poor bankers into making bad loans — not only persists, but seems to be growing in influence.

But this story is hardly unique. Ever since I began writing for the Times — and probably before, but I wasn’t paying so much attention then — I’ve been struck over and over again by the unkillability of zombie lies.

I mean, supply-side economics should have been killed by the Clinton years: he raised taxes on the rich, everyone on the right predicted catastrophe, and what followed was 8 years of rapid growth and surging revenues, with the budget actually moving into surplus for the first time in three decades. But no: the right interpreted all the good stuff as a lagged effect of the 1981 tax cut (which meant that LBJ deserved credit for Morning in America, but who’s counting?)

Or consider the California electricity crisis of 2001-2002. Years after we actually had tapes in which Enron traders could be heard telling power plants to shut down, news reports continued to repeat the conservative line that it was all about excessive regulation that wouldn’t let the power companies build capacity — with no mention at all of the market manipulation.

Something similar is happening on the foreign policy front; how likely is it that a random news article on the march to war in Iraq will actually describe what we know actually happened, as opposed to offering a whitewashed version? And so on and so on.

The right-wing refuses to learn from history, because they believe what they believe. It's the triumph of faith-based thinking over common sense. No evidence is going to change their mind. If they're right, despite the evidence, as they just know they are, it follows that they need to expunge the record. After all, if no one knows about the contrary evidence, it can't be used against them.

Deregulation? Heaven forbid! How could anyone think that the right-wing pushed financial deregulation in the years leading up to this economic collapse? And how could Wall Street have had anything to do with the financial crisis?

Well, for people who get all their "news" at Fox, history is exactly what the right-wing wants it to be. It was those sneaky Democrats who caused this collapse, despite Republican control of all three branches of the federal government in the years leading up to it. (Even in 2006, there were only 49 Democrats in the U.S. Senate, along with 49 Republicans and two Independents - hardly enough, as we've seen this year, to get their own way in anything.)

But we all know how those Democrats stick together and fight for what they believe, right? It's amazing how disciplined they are. Heck, they didn't even need to filibuster everything in those years. Amazing, isn't it? Almost... unbelievable, in fact.

You know something? History would have been a lot easier in school if you could just make it up as you went along. Maybe Republicans are onto something here. But how do they sleep at night?

-

Edit: Another very good post from Barry Ritholtz about this is here. You might also check out the New York Times article, by Joe Nocera, he references.

No comments:

Post a Comment