Quote of the Day:

My old teacher Charles Kindleberger once wrote that the existence of multiple measures of the balance of payments had one great virtue: they allowed observers, by picking and choosing, to be always optimistic or always pessimistic, depending on temperament.

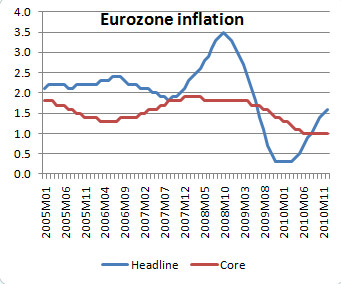

The same thing is happening now with inflation measures. In particular, by switching back and forth between core and headline inflation, you can manage to find reasons to fear inflation, no matter what.

Which brings me to Jean-Claude Trichet’s latest warnings about inflation. As the chart above (of 12-month changes) shows, eurozone inflation has behaved a lot like US inflation: low and falling core inflation in the face of a depressed economy, but big swings in headline inflation around that trend with fluctuations in commodity prices. But Trichet now says that the headline number is the one to watch.

Those of us whose memories stretch back more than a few months can only say, hmmmm.

First of all, if headline inflation is The One, why wasn’t the ECB all worked up about below-target inflation in 2009? Funny, I don’t recall a lot of speeches about the need for monetary loosening. Why, it’s almost as if the ECB switches between inflation measures to pick whichever one currently makes the case for tight money (a point Willem Buiter made a while back).

Second, the ECB made exactly the same argument back in 2008, and raised interest rates even as the world was sliding into financial crisis. One might have expected Trichet to be a bit humbled by that experience. But I guess not.

The ECB probably won’t tighten just yet. But it’s clearly gearing up to do the wrong thing as soon as possible. - Paul Krugman

No comments:

Post a Comment