Krugman writes clearly, yet succinctly (something I should learn), making complex issues simple to understand. He often uses superb graphs to illustrate his points. And that brings up another thing I should emulate: he backs up his opinions with concrete evidence. Finally, it's all so very interesting. If you want to learn something in an entertaining fashion, Krugman's blog is definitely for you.

Here's an example of a recent post:

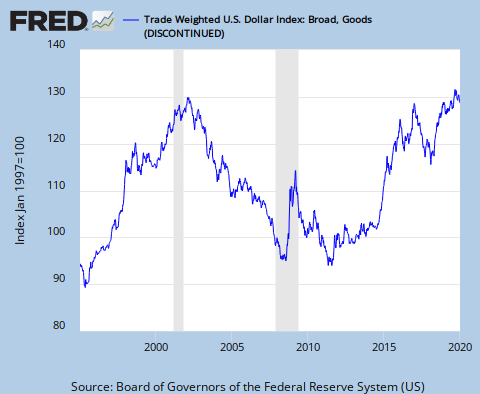

Some commenters seem to believe that there has been a massive depreciation of the dollar since Ben Bernanke began QE2, or more broadly since he began rapidly increasing the monetary base. But nooooo! [/end Belushi] The dollar briefly surged during the oh-God-we’re-all-gonna-die period of the financial crisis, then fell more or less back to where it was at the start of the recession. And all of these movements were small compared with the long dollar slide during the Bush years — a slide, by the way, which was never part of my critique of that era.

Interesting, don't you think? I've been hearing people scream about the decline of the dollar under Barack Obama, and I just assumed that was accurate. It didn't bother me, since a declining dollar will help exports and is probably what we need right now. But I did assume that there was something to it. I guess I should have known better, huh?

The dollar has indeed been declining, but it's still higher than it was in 2008, before Obama took office. And you never hear these right-wing critics complain about the long slide of the dollar on their watch. During the eight years of the George W. Bush administration, the dollar did pretty much nothing but decline.

Krugman also asks some great questions. For example, Chinese President Hu Jintao's comments on the U.S. dollar got a lot of press when he was visiting America. But Krugman asks, why should we care? What advantage do we derive from the special role our currency holds internationally?

All this is very reminiscent of the Japanese around 20 years ago. Back then I would go to conferences in which officials would talk about the importance of fostering the international role of the yen; I would comment that the yen’s international role or lack thereof wasn’t really very important; and the moderator would thank me for emphasizing the importance of the international role of the yen. I never found out whether it was bad translation, or whether this was a polite way of telling me that I had said something unacceptable.

So, let’s ask the question again: what advantages does America derive from the dollar’s international role?

There are two things I like about that. The first is just that he asks the question at all. Again, I've always just assumed that it was important. But assumptions aren't always valid. These are things we should think about, so I'm grateful to Krugman for bringing them up.

And I also like his comparing this with Japan. Remember the 1980s, when Japan was the unstoppable economic juggernaut against which we just couldn't compete? That seems pretty foolish now, doesn't it? (In fact, if you're too young to remember it, you might be astonished by the whole idea.)

So why are we doing the same thing with China? Nothing is inevitable. We can compete with China, if we have the intelligence, the courage, the determination to do so. We don't have to just give up! (Don't get me started.)

Anyway, that's just a brief excerpt. If you're curious about what Krugman has to say, check it out. Meanwhile, let me give you one more example. When you think about unemployment in European countries, how do you think it compares to America? The right-wing tends to use Europe as a bad economic example. Do you buy that?

Well, you might be interested in this post. Here's an excerpt:

In the 90s, with US employment surging while France (and much of Europe) was having trouble creating jobs, there was a lot of talk about the European employment problem. By the eve of the current crisis, however, the European job picture had changed a lot for the better, while even a business-cycle recovery didn’t seem to do much for US jobs.

Many Americans, even those who imagine themselves well-informed, don’t realize that there has been a big change here; my sense is that the US elite picture of Europe is stuck in a sort of time warp, in which it’s always 1997, and we have the Internet and they don’t. But things have moved on a lot since then.

Note that this is before the current economic collapse (I think France's unemployment rate is slightly worse than ours right now). And it's not that Europe is perfect, or even "better" than America. It's more that you don't want to hang on to outmoded perceptions. Other nations don't stand still, any more than we do. They learn and they adapt.

This is a similar lesson to that of Japan. Nothing stands still. America used to have the most competitive, innovative, dynamic economy in the world. But that, by itself, implies nothing about the future. We can be great - we can be greater in the future than we were in the past - but it's going to take hard work. It's going to take determination. It's going to take intelligent, clear-headed policies. And it's going to take courage.

It's certainly not inevitable. But it's not impossible, either.

Oh, well. I realize you can't read everything on the internet. And, of course, you don't want to pass up my blog, do you? Heh, heh. But if you've got the time, you might check out Paul Krugman's blog, and his columns in The New York Times, too. They're worth it.

No comments:

Post a Comment